DETECCIÓN AUTOMÁTICA

DE INCENDIO

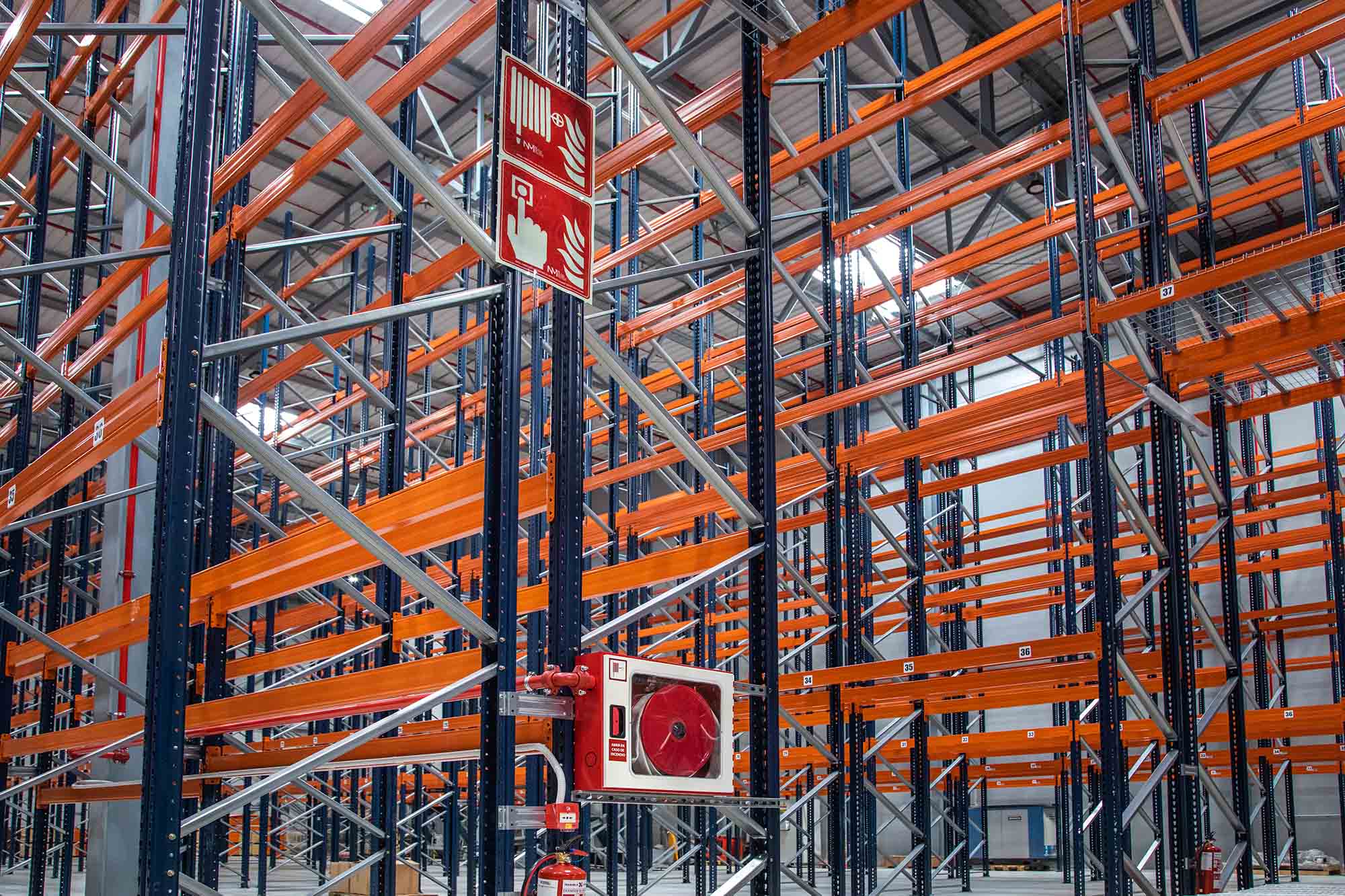

EXTINCIÓN AUTOMÁTICA POR AGUA: ROCIADORES RE Y RO

MARCAS QUE CONFÍAN EN NOSOTROS

ESPACIOS COMUNES

SISTEMAS DE PREVENCIÓN Y PROTECCIÓN DE INCENDIOS EN COMUNIDADES Y GARAGES

ESPACIOS PERSONALES

SISTEMAS DE PREVENCIÓN Y PROTECCIÓN DE INCENDIOS EN HOGARES

PREVENCIÓN DE INCENDIOS EN COMUNIDADES DE VECINOS

FACTOR HUMANO EN LA PREVENCIÓN Y PROTECCIÓN CONTRA INCENDIOS

0

Años de experiencia

0

Empresas protegidas

0

Edificios protegidos

0

Sistemas de protección instalados

PARTNERS

FAQ´S

PREGUNTAS FRECUENTES

Lorem fistrum por la gloria de mi madre esse jarl aliqua llevame al sircoo. De la pradera ullamco qué dise usteer está la cosa muy malar.

Lorem fistrum por la gloria de mi madre esse jarl aliqua llevame al sircoo. De la pradera ullamco qué dise usteer está la cosa muy malar.

Lorem fistrum por la gloria de mi madre esse jarl aliqua llevame al sircoo. De la pradera ullamco qué dise usteer está la cosa muy malar.

Lorem fistrum por la gloria de mi madre esse jarl aliqua llevame al sircoo. De la pradera ullamco qué dise usteer está la cosa muy malar.

BLOG

ÚLTIMOS POSTS

Protección

Protección pasiva versus protección activa contra incendios

La seguridad contra incendios es una preocupación fundamental en cualquier estructura, ya sea residencial, comercial o industrial. La prevención y la capacidad de respuesta efectiva

abril 4, 2024

Prevención

Consejos para la instalación de detectores de humo domésticos

En esta nueva entrada de nuestro blog vamos a proponer algunos consejos para la instalación de detectores de humo domésticos. Instalar un detector de humo

marzo 27, 2024

Prevención

Incendios en instalaciones fotovoltaicas en edificios

Los incendios en instalaciones fotovoltaicas en edificios son cada vez más comunes en nuestro país. Este tipo de instalaciones han crecido en España gracias a

marzo 20, 2024